See Instructions for Forms 1094C and 1095C 1095 and 1094 IRS copies for paper filers;Part III ALE Member Information Monthly Line 23 to Line 25 ALE Member Information Reminder Part III (Lines 2335) should only be completed on the Authoritative Transmittal for the employer In Column (a), if you offered Minimum Essential Covertage (MEC) to at least 95% of your fulltime employees and their dependents, enter "X" inDosar 10 din Tribunalul Ialomița, obiect omorul calificat (art1 NCP) art 32 CP rap la art 1 CP, categorie Penal, stadiul Fond

Ez1095 Software How To Print Form 1095 C And 1094 C

1094-c due date 2019

1094-c due date 2019-1094c 1921 Complete blanks electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents using a lawful electronic signature and share them via email, fax or print them out Save forms on your laptop or mobile device Improve your productivity with powerful solution?Admite cererea Admite cererea Lămureşte dispozitivul Sentinţei nr 303 din , pronunţată de Tribunalul Botoşani – Secţia a IIa Civilă, de Contencios Administrativ şi Fiscal în dosarul nr 10, în sensul că noua adeverinţă la emiterea căreia a fost obligată Primăria comunei Cristeşti

2

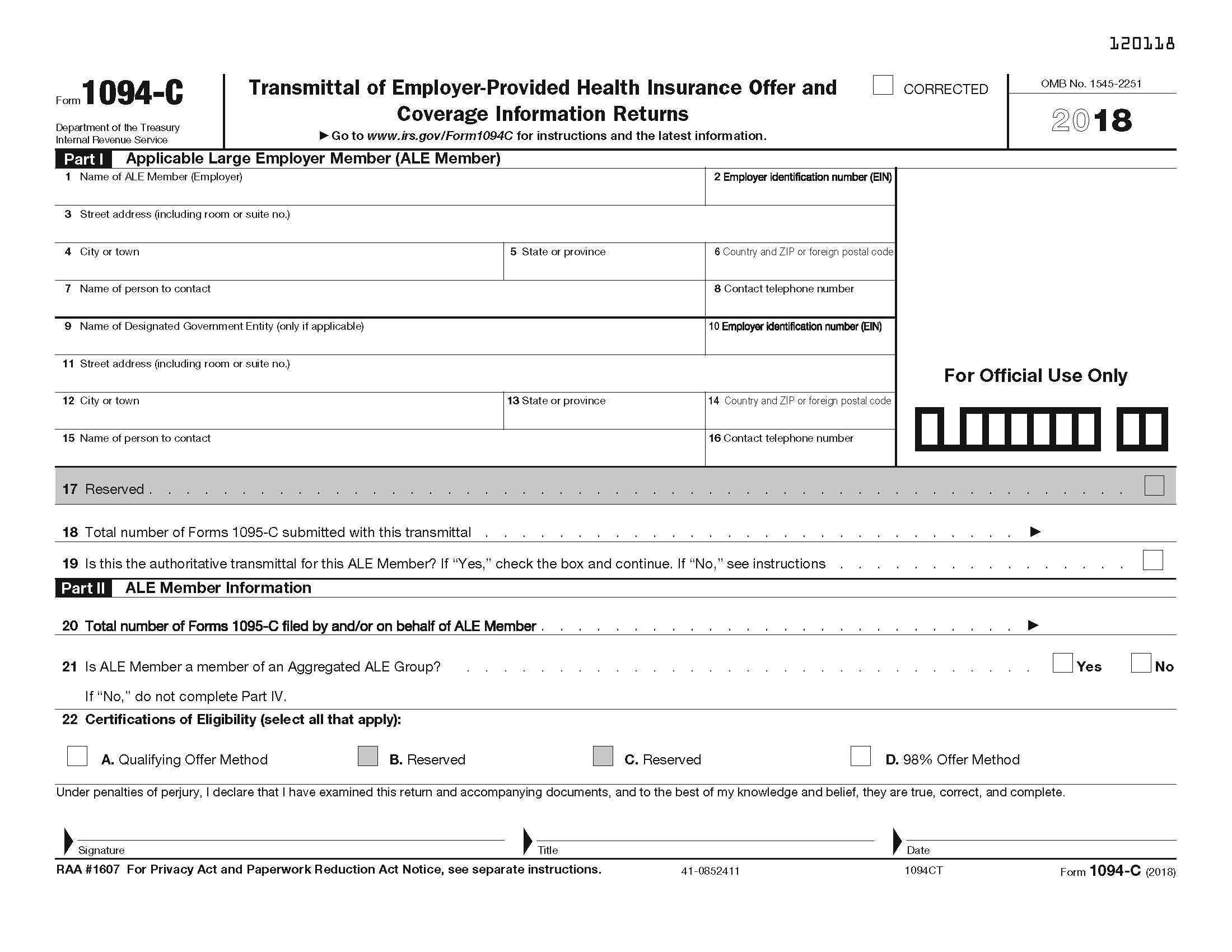

IRS Issues Draft 19 ACA Forms 1094C and 1095C and Reporting Instructions Joanna KimBrunetti The IRS has released draft versions of Forms 1094C and 1095C, as well as the reporting instructions for the 19 tax year, to be filed and furnished inDosar nr 1094/117/19 aflat pe rolul Tribunalul Cluj Partile, obiectul, termenele de judecata si solutia pronuntata in dosarul 1094/1 Check out the recently released Form 1095C for the 19 tax year here In addition to filing a 1095C, employers are also required to file a 1094C, which is basically just the cover sheet for all of an organization's 1095C forms (you must file one 1094C per tax ID)

The draft 19 versions of Form 1094C and 1095C are also available for download at the following links 19 Draft Form 1094C 19 Draft Form 1095C While these forms are not the final versions to be filed and furnished for the 19 tax year, they do serve as an accurate depiction of what employers should expect when preparing for 19 ACAJohn Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning Circle The IRS has released draft Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in accordance with

1921 form 1094c Fill out blanks electronically utilizing PDF or Word format Make them reusable by making templates, include and fill out fillable fields Approve documents by using a legal electronic signature and share them by way of email, fax or print them out download blanks on your PC or mobile device Enhance your productivity with effective solution?19 ACA 1094/1095 Deadlines Chart Due Dates in 19 Action Fully Insured ALEs SelfInsured ALEs SelfInsured Employers That are not ALEs (Fewer Than 50 FullTime Employees) Provide Form 1095C to FullTime Employees January 31 January 31 Not Applicable Provide Form 1095B to Responsible Individuals (may be the primary insured, employee, The IRS issued final versions for four ACA forms, including Forms 1094B, 1095B, 1094C, and 1095C The forms can be accessed using the following links Form 1094B Form 1095B Form 1094C Form 1095C The IRS also released full instructions for Forms 1094C and 1095C for employers and HR teams, as well as instructions for Forms 1094

Irs Announces Benefit Plan Limits For 19 Lockton Companies

1

From the 19 Instructions for Forms 1094C and 1095C Purpose of Form Employers with 50 or more fulltime employees (including fulltime equivalent employees) in the previous year use Forms 1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage forFor electronic filers For forms filed in 21 reporting coverage provided in calendar year , Forms 1094B and 1095B are required to be filed by , or , if filing electronicallyAbout Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us Creators

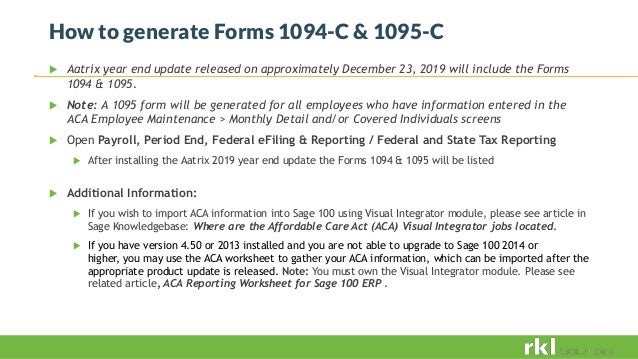

Ez1095 Software How To Print Form 1095 C And 1094 C

Benefit Advisors Network

Form 1094C gets auto generated based on the 1095C forms input inside the system This saves users time and simplifies the filing process As an employer you can think of the 1095C as the W2 form of ACA healthcare reporting and 1094C as the W3 transmittal of ACA reporting And the due dates are also similar The IRS released the draft instructions to the Forms 1094C and 1095C on While many, including us as discussed in our previous article, expected some changes as a result of the Individual Mandate being reduced to $0 beginning in 19, the draft instructions were virtually identical compared to the 18 iteration of the instructions @chibenefits For some reason this guidance didn't appear again in the annual ACA reporting delay notice for 19, but it was in the 18 notice and all prior years IRS Notice 1806 or for filing Forms 1094B, 1095B, 1094C, or 1095C are subject to penalties under section 6722 or 6721 for failure to timely furnish and file, respectively

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

2

1218 Form 1094C () Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTimeApplicable large employers with 50 or more fulltime or fulltimeequivalent employees use efileACAforms to save on the labor costs of preparing, printing, mailing and manually submitting their 1095C and 1094C forms to the IRS Smaller, selfinsured employers who must fill out the 1095B and 1094B transmittal form use efileACAforms to report the names, addresses andCPIP/1094/19 4 10 There is, of course, the reference to public transport in the assessment guide as set out above The representative for the Secretary of State (on my reading) says that a failure to consider a claimant's ability to use public transport, of itself, amounts

How To Efile A 1095 B Or 1095 C Correction Air

1095 1094 Aca Forms Ez1095 19 From Halfpricesoft Com Just Released Efile Version

19 Employer Reporting a 1094C and 1095C Refresher Draft 19 Forms and Instructions for Forms 1094C and 1095C have been released by the IRS, and we anticipate seeing final forms shortly Although 19 marked the end of the individual health coverage mandate penalties, very few changes have been proposed to the employer ACA reporting requirements After a lengthy and unexplained delay, the Internal Revenue Service released drafts of the 19 Forms 1094C, 1095C and their corresponding instructions on The forms and reporting obligations are basically unchanged from 18 There had been speculation that reporting might be streamlined due to the repeal For the filing year, Applicable Large Employers (ALEs) must provide Forms 1095C to employees by ALEs must submit Forms 1095C, along with Form 1094C, to the IRS by (if filed by mail) or (if filed electronically) Note Employers that are required to file 250 or more 1095C Forms must file electronically

2

Aca Complyright 19 Aca Tax Software Use For Forms 1095 B And 1095 C And 1094 B And 1094 C Tax Forms Office Products

Changes to the Form 1094C There are no other substantive changes to the Form 1094C Deadlines As of now an employer will have to furnish the 18 Form 1095C to certain employees by The Form 1095C is by far the more complicated Form and providers who are not automating the process will undoubtedly struggle to meet thisFor the Tax year, the deadline to furnish ACA Forms to the employees is extended to On , the IRS released the final instructions of the Form 1095C to be used for reporting in the tax year The revised Form 1095C has a new line (Line 17, Zip Code) related to ICHRA informationCseries Humana Northern Kentucky Chamber Association Plan IRS Reporting If the employer does not optout during the optout period, Humana will complete the 1094/1095B reporting requirements for them They can also visit the IRSgov site and/or speak to their tax advisor to determine if their Association has 1094/1095C filing requirements

Irs Releases Draft 19 Aca Reporting Forms And Instructions Fedeli Group

2

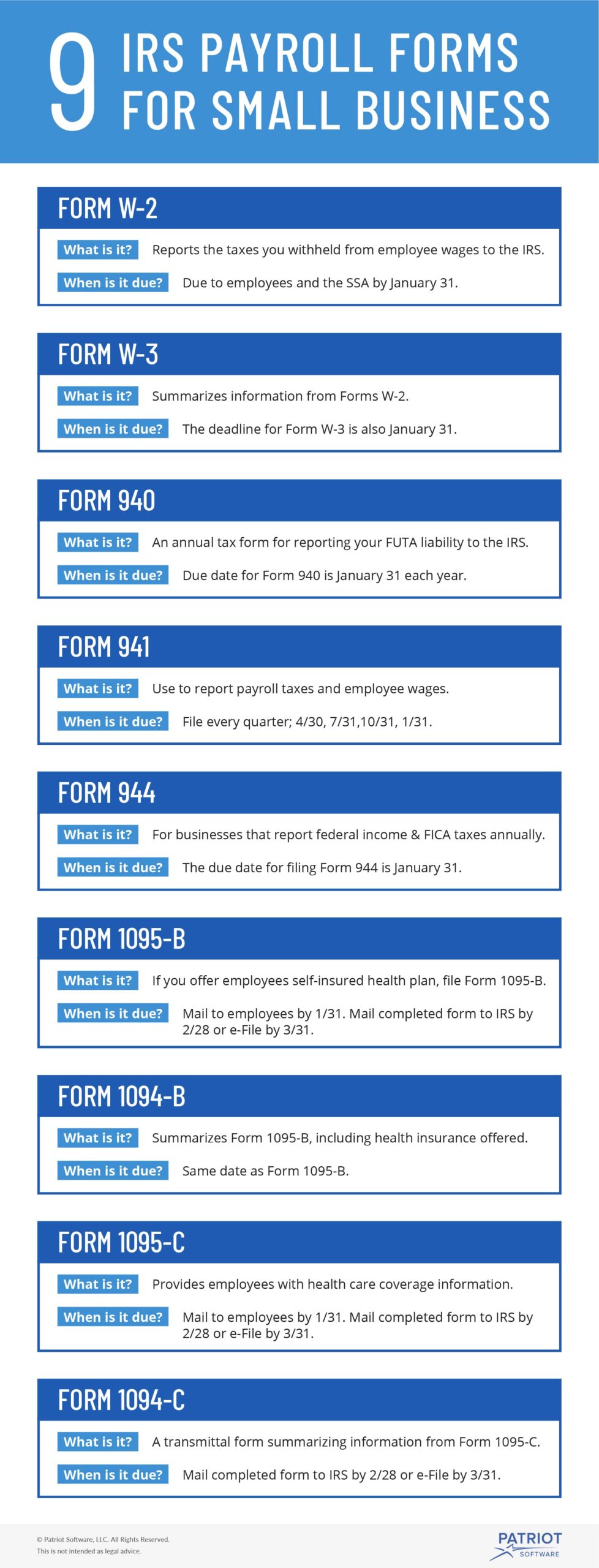

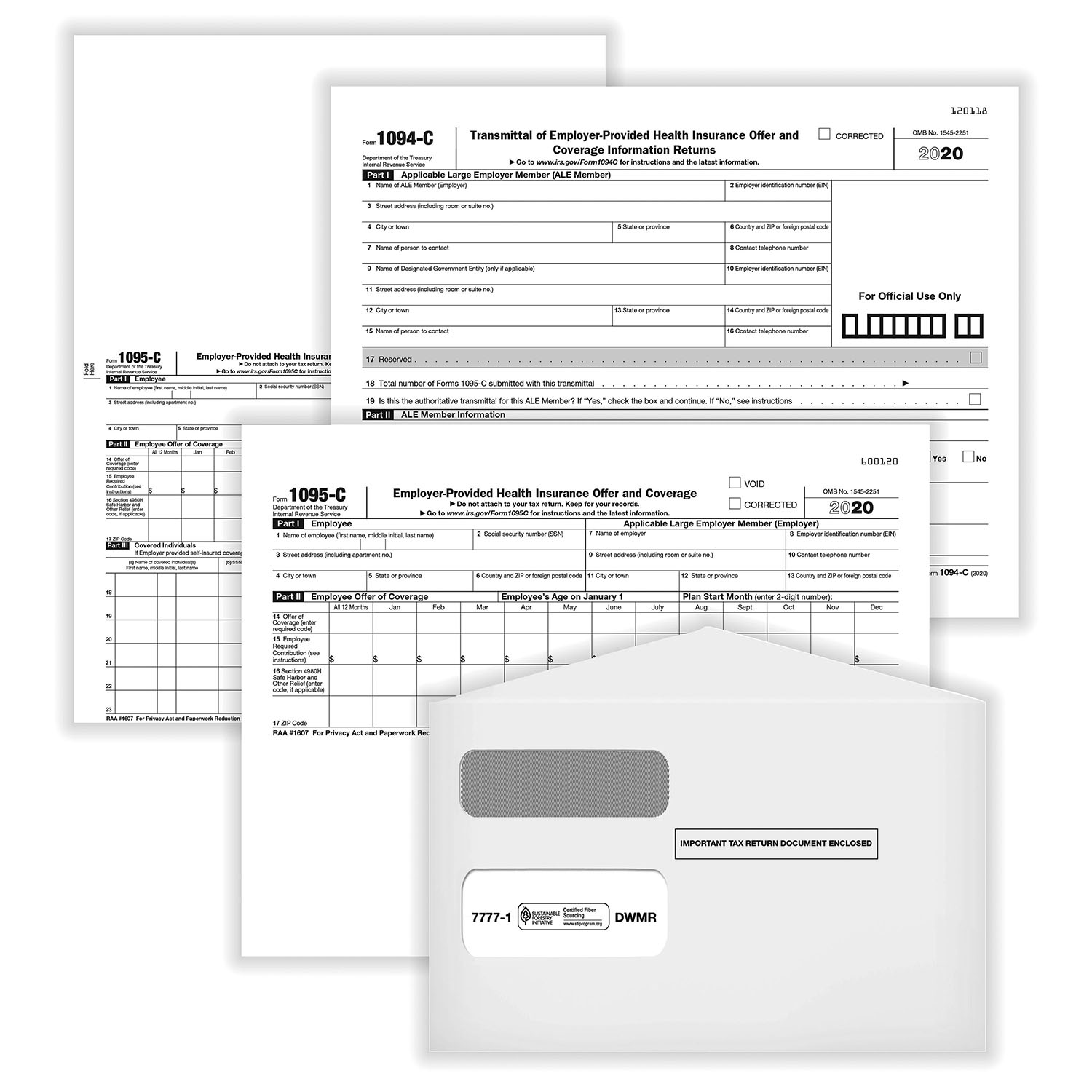

IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095CForm 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employees However, the IRS extended goodfaith transition relief from penalties to ALEs for incorrect or incomplete information on 1094C/1095C for the 15 through tax filing year, similar to the extension they provided during the 19 tax filing season

Completing The 1095 C Form For Mandatory Aca Reporting

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

Fill Online, Printable, Fillable, Blank F1094c 19 Form 1094C Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable F1094c 19 Form 1094C On average this form takes 35 minutes to complete year (April 1 in 19), if an employer files these Forms electronically Employers who issue less than 250 1095C information returns may file paper copies of the Forms, but paper filings must be transmitted to the IRS by IRS FORM 1094C TRANSMITTAL FORM GUIDANCE Part I Cells 18 Complete all blocks Sequoia Blog ACA Reporting Deadlines in 19 18 IRS Instructions for Forms 1094C and 1095C 18 IRS Instructions for Forms 1094B and 1095B IRS Guide for Electronically Filing Affordable Care Act (ACA) Information Returns

2

A New Role For Anaesthetists In Environmentally Sustainable Healthcare Shelton 19 Anaesthesia Wiley Online Library

1094C (19) 1218 Form 1094C (19) Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e) Reserved 23;Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16 The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year No material changes have been made to the forms, either from prior years or from the drafts released in November (see our Checkpoint article) (The "Instructions for Recipient" included with Form 1095B and 1095C have been revised to

2

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

The IRS has released the Forms 1094C, 1095C, 1094B, and 1095B that employers will use in early 19 to report on the group health insurance coverage they offered during the 18 calendar year Instructions on how to complete Forms 1094C and 1095C and Forms 1094B and 1095B have also been released As a reminder, employers with 50 or more The 1094C is your title page, and the 1095C is the actual report itself And in this case, the report contains vital details about each employee's health insurance for the year Together, these forms are used to determine whether youSedinta din data de la ora 900 Complet CAFN*2;

Totalsource Adp Com Demos Userguides Benefits Enrollment Core Aca Tax Reporting Data Collection Guidee Pdf

Reporting Tool Overview The National General Benefits

1095c due date 1921 Complete forms electronically working with PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents by using a lawful electronic signature and share them via email, fax or print them out download documents on your personal computer or mobile device Boost your efficiency with effective The IRS imposes penalties for late filing of Forms 1094C and 1095C or for late furnishing of Forms 1095C under Internal Revenue Code (IRC) Sections 6721 and 6722 These penalties can be huge depending on the number of late Forms 1095C, at a rate of $270 per form for failure to file and an additional $270 per form for failure to furnish forBack to 1094C Form Guide ;

Http Cbplans Com Wp Content Uploads 19 12 Aca 19 Final Forms 1094 C And 1095 C Issued Pdf

2

The 1094C form is not considered a correction by the IRS if it is being submitted as the cover page for one or more corrected 1095C forms The accompanying 1094C form is simply a new form and the data on it should reflect what is being submitted with it (eg, if 1 form needs correcting, Line 18 on the 1094 form will state "1" evenDosar nr 10 aflat pe rolul Tribunalul Tulcea Partile, obiectul, termenele de judecata si solutia pronuntata in dosarul 101094C and all 1095Cs with the IRS3 WHAT'S NEW While the Forms remain substantially the

Www Irs Gov Pub Irs Utl Instructions for ty18 predefined aats scenarios Pdf

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

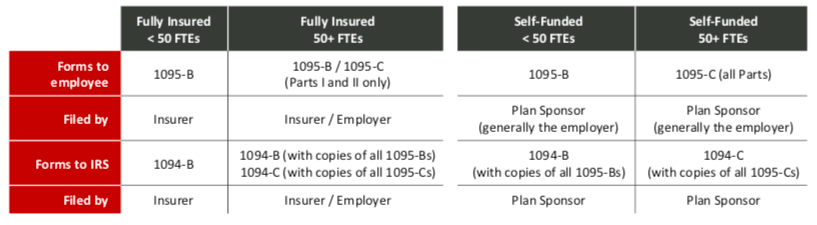

All applicable large employers (ALEs) must file Forms 1094C and 1095C with the IRS and furnish a copy of the 1095C to all fulltime employees The insurance carrier for a fully insured plan must complete Forms 1094B and 1095B Generally, only employers that are nonALEs with a selfinsured plan will complete Forms 1094B and 1095BOverview of Form 1094C Form 1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employees and that status of individual employee's enrollment

Aca Compliance Filing Deadlines For The 18 Tax Year

What You Need To Know About 1094 Forms Blog Taxbandits

Irs Releases Draft Forms And Instructions For 19 Aca Reporting Michigan Benefits Agency Strategic Services Group Ssg

What Is The Difference Between Forms 1094 C And 1095 C Turbotax Tax Tips Videos

Form 1095 A 1095 B 1095 C And Instructions

Use Alio To Meet Federal Requirements 19

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

Irs Releases Draft 19 Forms 1094 And 1095 And Related Instructions

2

19 Aca Reporting Update Hub International

Irs Releases Final Forms And Instructions For 19 Aca Reporting Brinson Benefits

2

Code Series 2 For Form 1095 C Line 16

Sage 100cloud Year End Processing And Payroll Webinar 19

Irs Finally Finalizes 19 Forms 1094 And 1095 And Related Instructions

2

Irs Issues Draft 19 Aca Forms 1094 C And 1095 C And Reporting Instructions The Aca Times

9 Irs Payroll Forms For Small Businesses To Know About

2

Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns All Pages B1094cs05 21 41 25

2

Irs Releases Draft 19 Aca Reporting Forms And Instructions Fedeli Group

2

3

It S Year End Time Again Are You Gp Payroll Ready Erp Software Blog

2

1094 C 1095 C Software 599 1095 C Software

Common Mistakes In Completing Forms 1094 C And 1095 C

1

E File Form 1099 Misc Online Irs Forms Efile Filing Taxes

Irs Releases Forms 1094 1095 And Instructions For Early 19 Aca Reporting

Clearpath Benefit Advisors Employee Benefits Columbus Ohio Irs Releases Draft 19 Instructions For Forms 1094 B 1095 B 1094 C And 1095 C

19 Health Plan Compliance Deadlines Tsg Financial

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Ez1095 Software How To Print Form 1095 C And 1094 C

2

1094 C Irs Transmittal For 1095 C Forms For 5500 Tf5500

Irs 1094 C Form Pdffiller

Legal Alert Irs Releases Draft 19 Aca Reporting Forms And Instructions Spring Consulting Group

Irs Releases Draft 19 Aca Reporting Forms And Instructions Alera Group

Q Tbn And9gcqfkwn5kldls95udr6fjjdp6i8lwd6lrj1nrznfn Mfozhc C Usqp Cau

Aca Deadlines Penalties Extension For 21 Checkmark Blog

1094 C Transmittal Of Employer Provided Health Insurance Forms Fulfillment

Your 1095 C Obligations Explained

Filing Form 1094 C Youtube

Irs Releases Forms 1094 1095 And Instructions For Early 19 Aca Reporting

1094 C 1095 C Software 599 1095 C Software

Aca Reporting Generate Review Your 1094c 1095c Data And Forms

2

Ez1095 Software How To Print Form 1095 C And 1094 C

Vehi Org Client Media Files 19 Ale Sds Sus Reporting Information Guide 1094 95 C Forms Final V3 Pdf

18 Affordable Care Act Update Bkd Llp

2

Procedures To Print The 1094 C And Mail The 1094 C And 1095 C S To The Irs Integrity Data

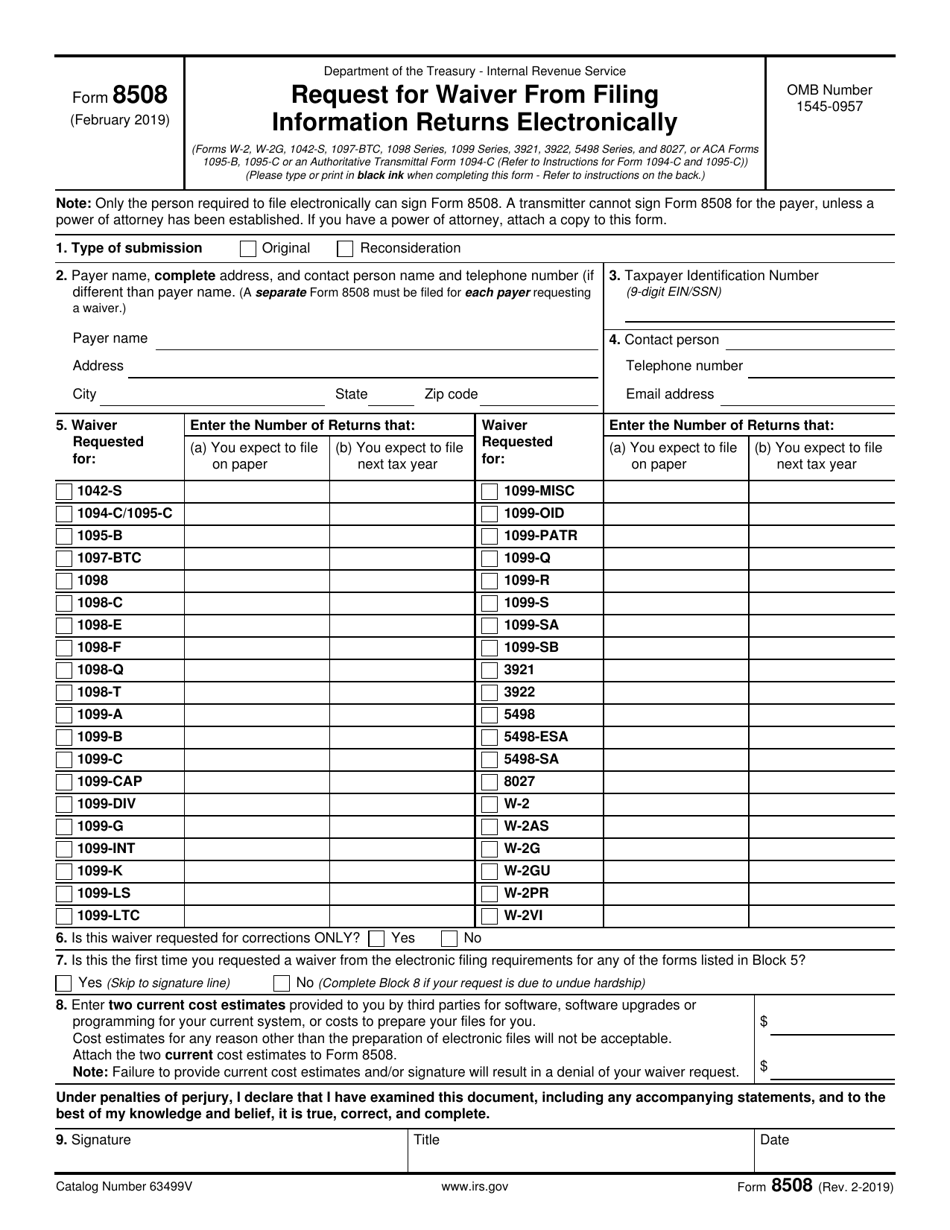

Irs Form 8508 Download Fillable Pdf Or Fill Online Request For Waiver From Filing Information Returns Electronically Templateroller

Compliance Recap July 19

Irs Releases 1094 C 1095 C Forms For 19 Tax Year

Www Irs Gov Pub Irs Prior Ib 19 Pdf

Blog Irs

Form 1094 C The Aca Times

Affordable Care Act Form 1095 C Hrdirect

2

2

Form 1095 C Guide For Employees Contact Us

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

21 Aca Compliance Checklist For Employers Integrity Data

The 19 Aca Reporting Is Due In Early Final Forms And Instructions Released Narfa

Www Irs Gov Pub Irs Utl Production Known Issues Ty18 Pdf

Your 1095 C Obligations Explained

Irs Drafts Of New 16 Forms 1095 C 1094 C Leavitt Group News Publications

Upcoming Key Compliance Deadlines And Reminders For First Quarter Lockton Companies

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

Form 1095 A 1095 B 1095 C And Instructions

Avoid Common Errors This Aca Reporting Season Health E Fx

Irs Releases 1094 C 1095 C Forms For 19 Tax Year

2

Aca Complyright 19 Aca Tax Software Use For Forms 1095 B And 1095 C And 1094 B And 1094 C Tax Forms Office Products

Compliance Update Forms 1094 C And 1095 C Calcpa Health Trusted Health Plans For Cpas

0 件のコメント:

コメントを投稿